Navigating the Headlines

"Rather than spending your time thinking about what is going wrong, spend more time thinking about what is going right!"

Here we go again!

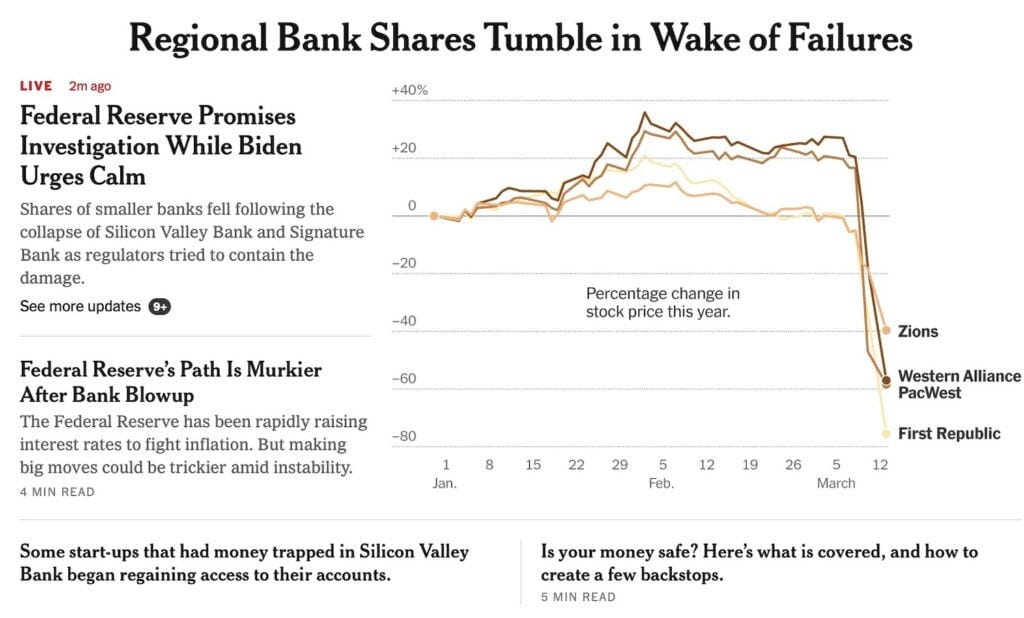

Scary headlines! Like this screenshot of the New York Times site, I grabbed yesterday!

It is important, however, to put these scary headlines into context.

It's also critical to keep remembering that the collapse of the two banks was more due to leadership incompetence, aided and abetted by regulatory changes for the worse - rather than any widespread underlying economic weakness. (Though one does wonder how much incompetence is out there!)

The sad thing about this state of affairs is that we are now, once again, living through a sort of 'economic whiplash' - people were just starting to return to a state of optimism, and for many, that optimism will now have taken a dent. Overall, this will have implications for the economy going forward - it will reinforce the indecision that causes many organizations to pause their actions, defer their initiatives, and focus on pulling back on the steps necessary to move forward.

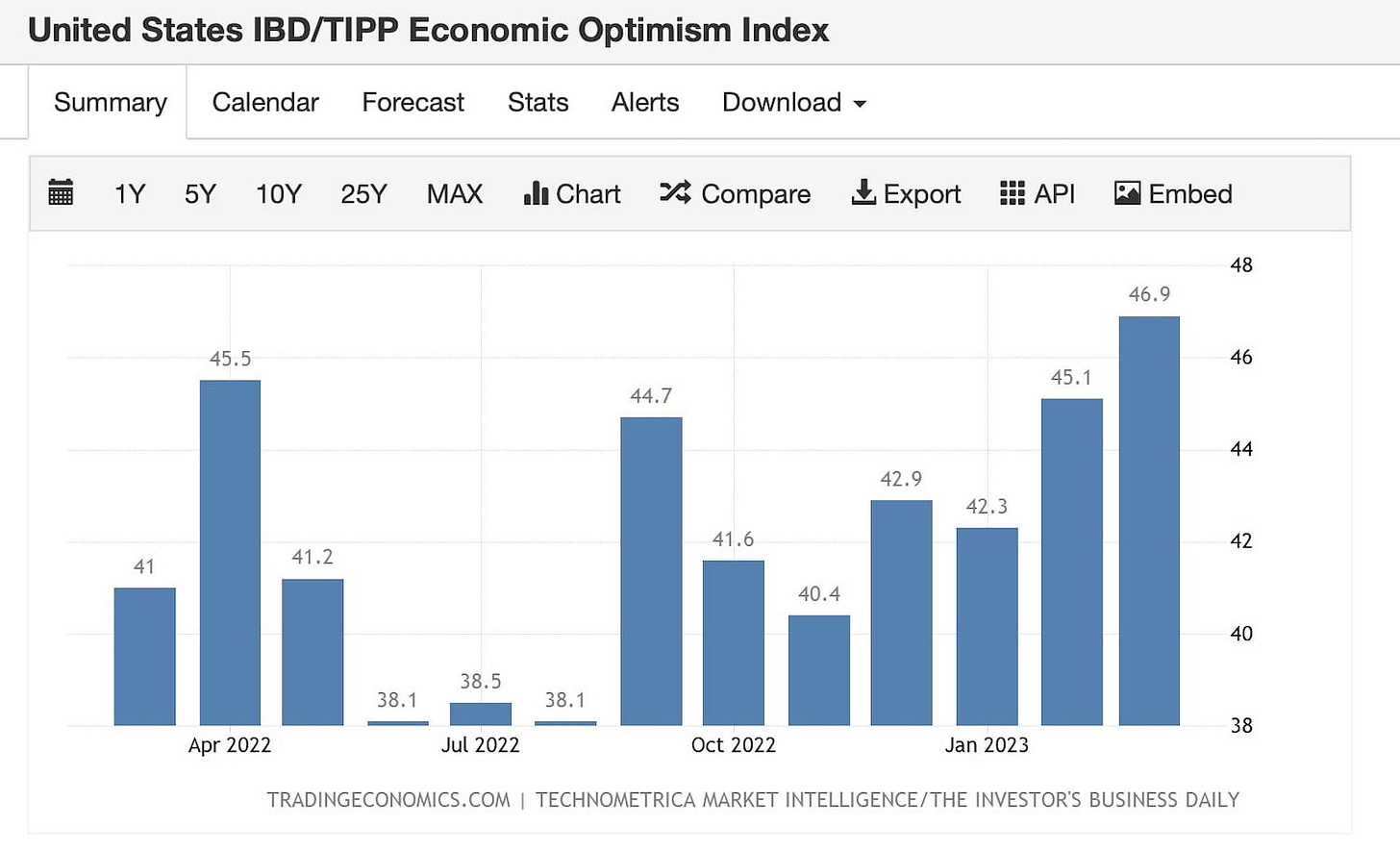

Consider how the well-regarded and much-watched 'optimism index' was trending upwards; people were generally feeling much more optimistic despite all the relentless talk about a potential recession.

We still had a long way to go return to previous levels of optimism, but there were definitely signs that people were feeling better about the future, with the index just hitting a new high level for the year just last month.

The IBD/TIPP Economic Optimism Index, a leading national poll on consumer confidence, increased for the second consecutive month. Its March reading of 46.9 improved by 4.0% over February's reading of 45.1. Though the index remains in negative territory for the 19th month, this month's reading is now the index's highest since December 2021 (48.4). A reading above 50.0 signals optimism and below 50.0 indicates pessimism on IBD/TIPP indexes.

The IBD/TIPP Economic Optimism Index has established a strong track record of foreshadowing the confidence indicators issued later each month by the University of Michigan and The Conference Board.

Press Release: IBD/TIPP Economic Optimism Continues to Rise in March

7 March 2023, Dow Jones Institutional News

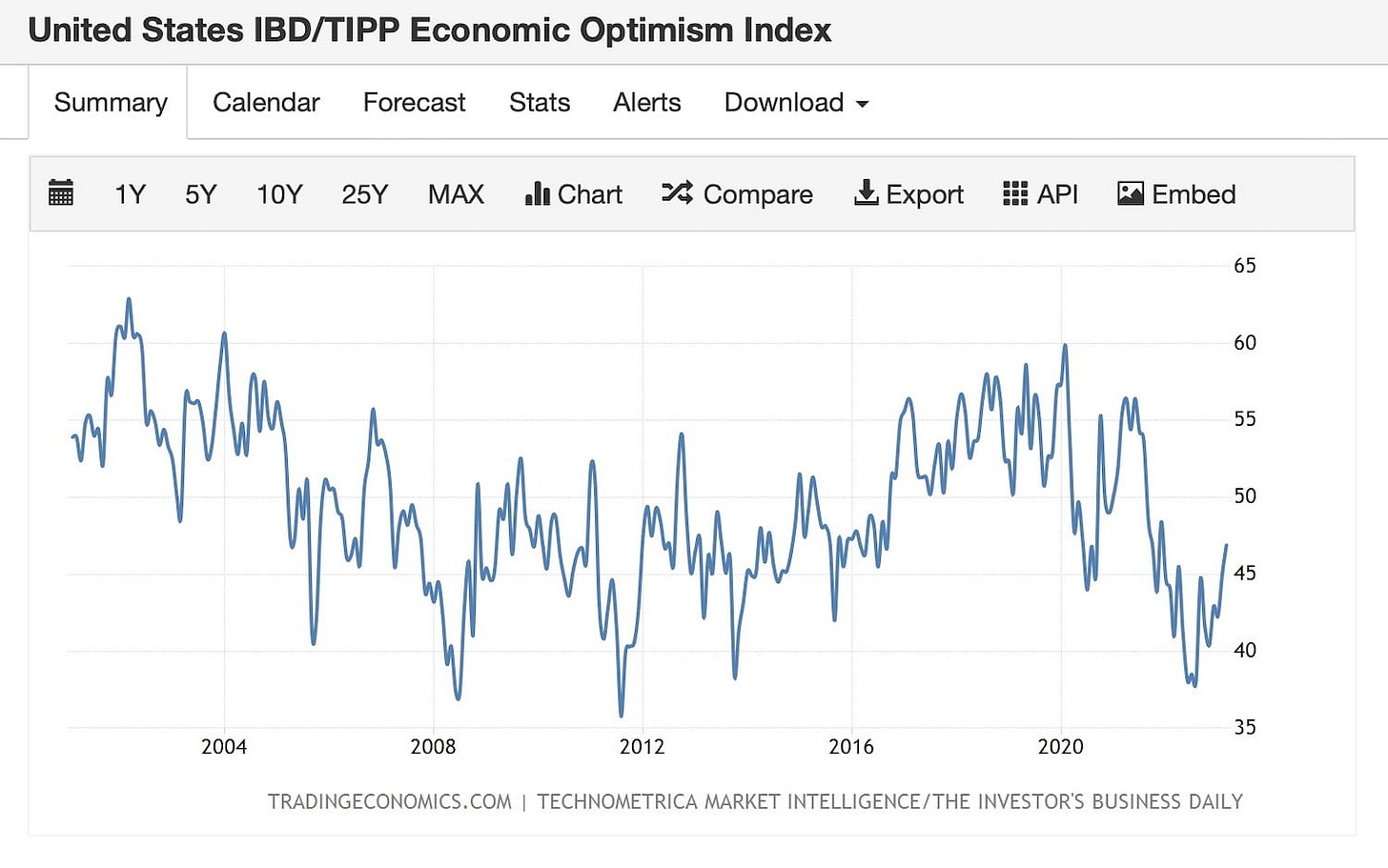

On a 25-year basis:

So now what? At times, like these, I work hard to remember the signals for optimism. My optimism is found in these fundamental beliefs (based on a blog post I wrote on November 9, 2016 - '10 Reasons Why I Still Believe in the Future'. I've shared it before but will share it again.

My case for optimism is described in that post - with the long-term trends that define our world:

science still exponentiates

knowledge still accelerates

the global idea machine still reverberates

big thinkers still think of how to solve big challenges

hyper-connectivity still provides for a reimagined future

inventors still invent

dreamers still dream

innovators still innovate

doers still do

teachers still teach

change agents can still effect positive change

optimism can always overcome pessimism

no barrier to the future is insurmountable with the right determination

at the end of the day, the majority of people are still decent

That's my original list. I'll add to it all the positive things that leadership teams and organizations have learned since the global pandemic began, learning how to:

be more agile and flexible

accelerate the adoption of business models

accept the inevitably of the business model and product shift that is underway in many industries

collaborate faster, within teams and across organizations

be more adaptable to new methods of interaction, internally and with customers, suppliers, and partners

eliminate old barriers to new ideas

eliminate decision-making paralysis

For me, at times like these, it should be pretty obvious that you should let optimism be your guide. Sometimes, that is best done by shifting your mind away from short-term volatility to long-term opportunities.

In that context, the future is still full of opportunity - and you are richer than you think!

Futurist Jim Carroll believes that volatility is the new normal, uncertainty is the new enemy, managing complexity is the new necessity and ambiguity is our new reality. Master those issues, and you've got the future nailed.